The Board of County Commissioners and other taxing entities set a property tax rate called a “millage rate”, which is used to calculate your overall property taxes. A “mill” is equal to $1 of tax for every $1,000 of assessed property value. The biggest challenge to Union County is the limited tax base. It is the smallest county in the State, so the amount of land available to tax is less than any other county. Furthermore, a large portion of the land is not subject to tax because it is owned by the Florida Department of Corrections.

HOW YOUR TAXES ARE CALCULATED

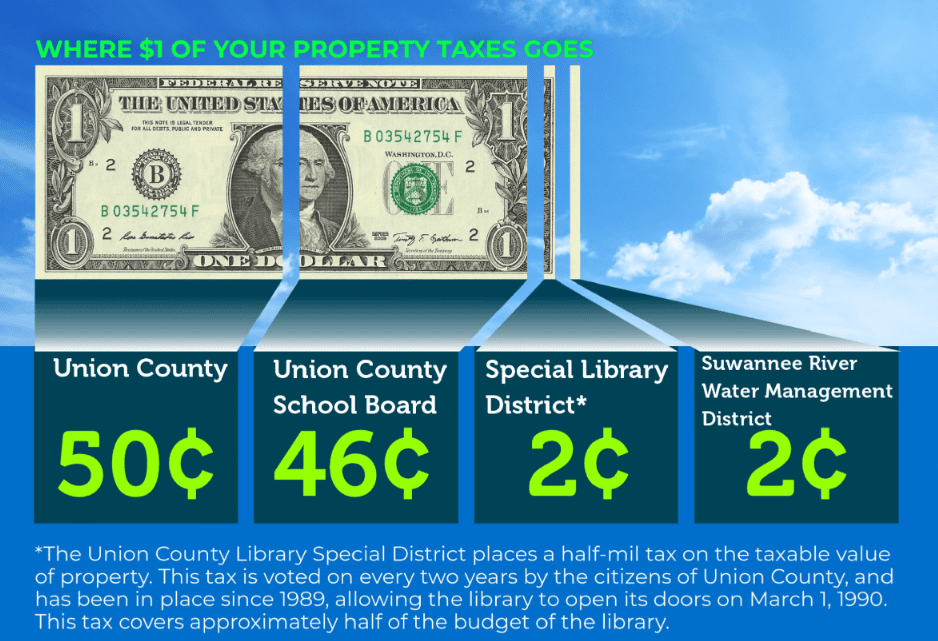

| Union County School Board | Union County | Special Library District | Suwannee River Water Management District |

|

| Assessed Value of Property | 100,000 | 100,000 | 100,000 | 100,000 |

| Less: Exemption(s) | 25,000 | 50,000 | 50,000 | 50,000 |

| Taxable Value | 75,000 | 50,000 | 50,000 | 50,000 |

| Taxable value divides by 1,000 | 75 | 50 | 50 | 50 |

| Millage Rate | 6.144 | 10.000 | 0.500 | 0.384 |

| Taxes Levied | $461 | $500 | $25 | $19 |

Information provided by Clerk & Comptroller Kellie Hendricks Rhoades, CPA

www.UnionClerk.com